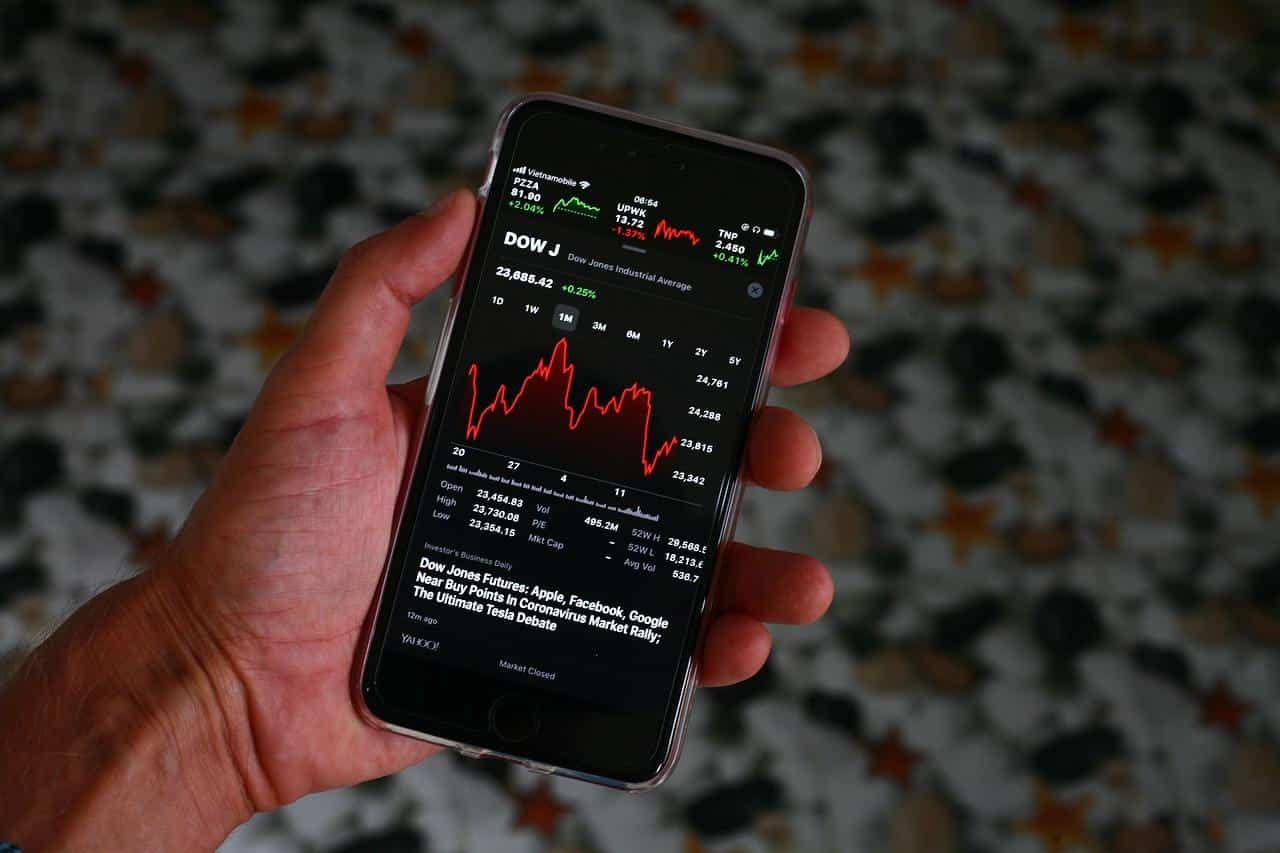

Apple has a historically bad day on the stock market.

Apple didn’t have the best day on the stock market today, with the stocks plunging about 8% over the course of Thursday. The drop lowered Apple’s stock prices to about $146 dollars, meaning that the company ended up losing close to $55 billion in its market price. Other sources say that the stock prices dropped 8.5%, which would equate to a $64 billion loss.

If accurate, this would be one of the biggest single day losses in the past while for Apple. Having said that, though, the tech companies share prices have been dropping somewhat consistently over the past few weeks, being worth close to $200 at the beginning of December 2018.

Overall, the company’s share prices have dropped by close to 40% over the last several months, coming from an all time high of $233.47 per share to a major low of just over $146, almost a $100 drop in a little over three months. All told, its market share has dropped to $647 billion over the course of the last few months. This makes the current leader is loss of market share in the vast majority of the other S&P 500.

Why Is Apples Stock Taking A Plunge?

There are a host of reasons behind why Apples share price has dropped so much over the past several months, and many of them date back to the release of the iPhone X and sales not meeting expectations. More recently, however, Thursdays plunge was the direct result of a meeting between management and a number of investors early in the day.

Trading was initially halted during the meeting, over the course of which it was explained to investors that holiday sales were not only lower than previously expected, but significantly lower. According to a number of reports, Apple blamed slowing iPhone sales in the likes of China, where expectations were that sales would bounce back. This ultimately meant that there would be slower growth than previously thought.

Because of that, as well as a number of other factors, Tim Cook believed that Q4 2019 revenue would be around the $84 billion worldwide, and not in the expected $89 billion to $93 billion that they first believed. In the case of the slowing sales in China, Mr. Cook also partially placed the blame on trade war between America and China.

According to Mr. Cook, the growing tensions between the two countries has led to American products as a whole being sold less in China, meaning that as tensions increase Apple may see less and less sales across the Chinese market. That doesn’t mean that he placed the blame entirely on the current U.S-China trade war.

He also noted that a strong US dollar and reduced replacement battery prices were having an effect on company profits. Extra tariffs on American products is just one of the few big issues that is making its presence felt on market shares. While Apples iPhones may not be as heavily tariffed now as they were several weeks ago, Donald Trump has announced that many Chinese parts that Apple uses in its iPhone may be hit next by the tariffs.

Not only will that have an impact on the companies bottom line, but it may have helped drive Apples stock prices down even further amid fear that profits will suffer too much over these tariffs. Currently, Apple are one of the biggest importers of Chinese goods in the U.S, so many tariffs that target Chinese goods will directly affect Apple.

However, the U.S and China agreed to put a hold on tariffs in December; that being said, though, this truce is only set to last until March 1. If no resolution is reached by then, which may seen likely, then this will have an even more negative impact on Apples share price. Furthermore, US Trade Representative Robert Lighthizer has reportedly considered implementing more tariffs before that point.

Regardless of whether or not more tariffs are implemented, Mr. Cook has made it clear that Apple and a host of other American companies are starting to feel the effects of the current administrations trade war with the Chinese government. The situation also makes it clear just how interwoven many U.S companies are with businesses in China.

Because of that, the implementation of U.S tariffs on China, and vice-versa, will continue to hamper many businesses abilities to actually do business.

Because of these overall market factors, as well as a few others, it’s unlikely that Apples stock prices will start to bounce back anytime soon; at least they won’t bounce back to near the $200 per stock anytime soon. Not that that’s going to have too much of an impact in the short-term; instead it’s mainly going to be a problem in the long-term, unless Apple manage to find a way to steady the ship.

Should the tech giant manage to find a way to flatten out and stop their share price from plunging any further, then they stand a chance of creating a historic streak of stock losses. That, though, would be quite a feat in itself, never-mind bringing stock prices close to their all time high.